Most Popular Service

500+

Companies Formed

24/7

Expert Support

9+

Countries

Why Choose Us

We deliver excellence through expertise, innovation, and commitment to your success

Setup to Expansion

Support from business setup to compliant scaling assistance.

Regional Expertise

Local market knowledge with expert legal execution.

Global Network

Boutique service with strong worldwide business connections.

Responsive & Reliable

Quick responses, timely delivery, and tailored solutions.

Our Comprehensive Services

Explore our financial and accounting solutions tailored for global businesses and NRIs.

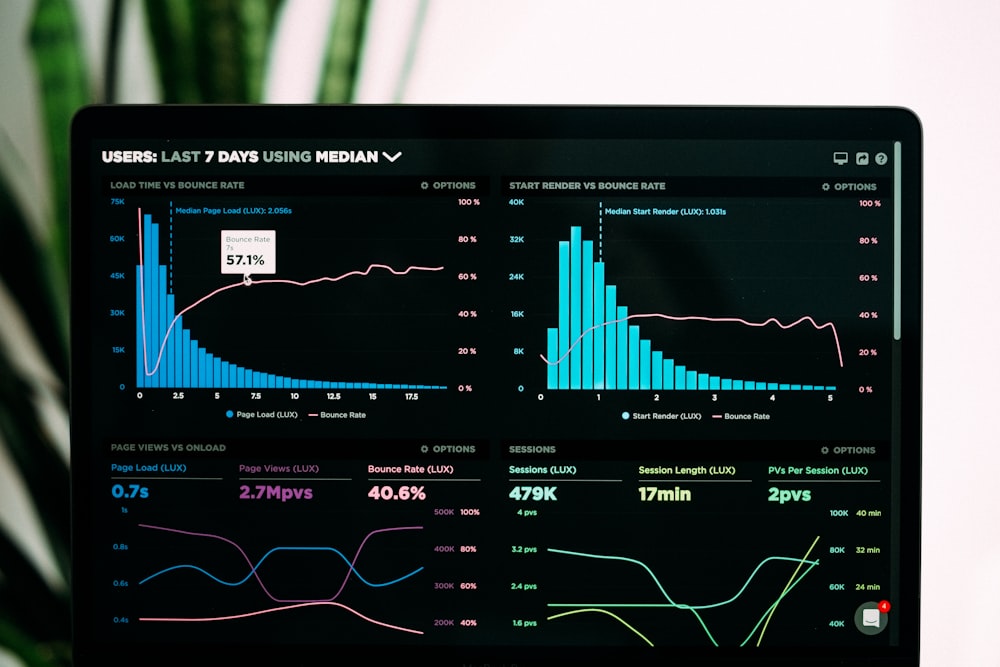

Powerful Tools & Resources

Simplify your financial decisions with our free tools

Corporate Tax Calculator (Singapore)

FreeCompute tax liability with applicable deductions & surcharges.

Ready to accelerate your business growth?

Schedule a consultation with our experts to discuss your specific needs and goals.